AI solutions for reinsurance workflows

We focus on a small number of well-defined use cases where AI can reliably support reinsurance teams — without disrupting existing governance and processes.

Designed for underwriting, pricing, capital, operations, and strategy teams.

Where we apply AI today

Four solution areas that map directly onto real reinsurance workflows.

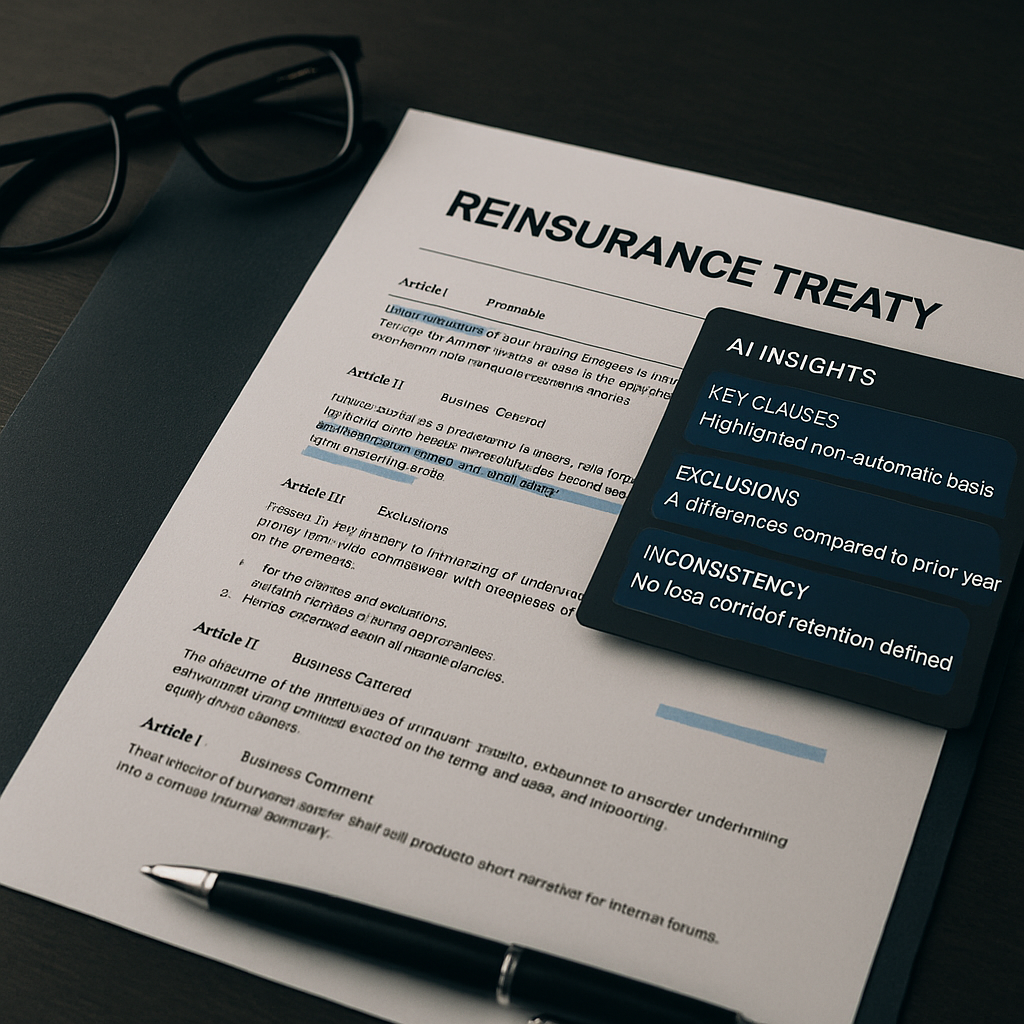

Contract & treaty intelligence

Turn treaties, slips, and wording-heavy documents into structured insight. Extract clauses, highlight exclusions, and flag potential inconsistencies.

Pricing & portfolio support

Provide context around pricing and capital decisions with structure comparisons, scenario views, and concise narratives for committees.

Operational efficiency

Reduce manual effort in submissions, data cleaning, reconciliations, and reporting — while maintaining auditability and controls.

Exploratory pilots

Test new ideas safely: narrow pilots, clear success criteria, and a documented decision on whether to scale, pause, or park.

Example outcomes

How these solutions show up in practice for our partners.

Faster treaty review

Underwriters receive a structured summary of key clauses and differences versus prior years in minutes instead of hours.

Clearer pricing context

Pricing and portfolio teams see how alternative structures affect loss ratios and capital, with simple, board-ready explanations.

Cleaner data flows

Operational and claims teams spend less time on manual reconciliations and more time on exceptions and judgement calls.

Explore a solution for your workflow

If you recognise one of these areas — or have a different idea in mind — we can start with a focused, low-risk conversation around a single use case.

contact@reinsuranceanalytics.io